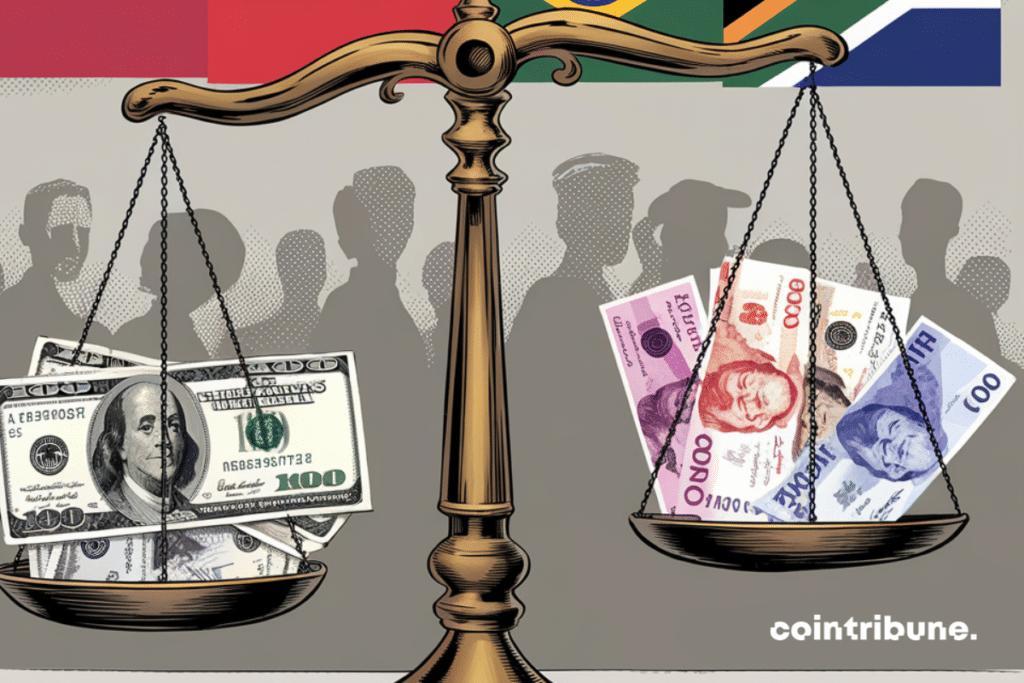

At the BRICS Business Forum, the nations of this emerging alliance unveiled their brand new cross-border payment system: BRICS Pay. The initiative represents a clear desire to reduce dependence on the US dollar, the currency that still dominates global transactions. As the BRICS countries seek to emancipate themselves from the financial influence of the United States, the creation of an autonomous payment system could redefine the rules of international trade.

Reaction to dollar dominance

BRICS member countries have been trying to find an alternative to the US dollar in their international trade for several years. The launch of BRICS Pay is part of this de-dollarization strategy, which is supported by Russia and China in particular. During the official announcement, Valentina Matvijenko, Chairwoman of the Federation Council of the Russian Federation, made this desire clear: “BRICS Pay is no longer a simple idea, it is a concrete project that is moving forward quickly.” The goal is to reduce the influence of the dollar, which still represents 58% in 2022 international payments outside the eurozone. This dominance of the dollar, along with economic sanctions imposed by the United States on countries such as Russia, has strengthened the BRICS’ resolve to establish a more resilient cross-border payment system.

The new system relies on financial infrastructures already installed in each country, such as the Mir network in Russia or the Unified Payments Interface (UPI) in India. With the compatibility of systems within the same platform, BRICS aims to facilitate transactions without going through traditional Western-dominated financial circuits. Russian Finance Minister Anton Siluanov also emphasized that BRICS Pay will be “based on advanced technologies that enable faster and cheaper foreign trade transactions without external intervention.” The first public demonstration took place this week in Moscow and foreshadows what this alternative to SWIFT could become.

Solutions based on blockchain and beyond

In addition to breaking free from the dollar, BRICS Pay can also redefine the landscape of international payments through blockchain integration. According to available information, the BRICS cross-border payment system could use this technology to verify transactions, thereby ensuring fast, transparent and secure exchange between member states. Russian minister Anton Siluanov said the system would “use blockchain to verify transactions and ensure efficient payments between countries.” This would allow the BRICS to reduce the costs associated with international trade in order to break away from the monopoly exercised by traditional platforms such as SWIFT.

Moreover, this technological advancement also opens the door to interesting perspectives. Through the creation of a decentralized payment ecosystem, BRICS Pay could be adopted not only by member countries, but also serve as a model for other states trying to reduce their dependence on the United States and the West. The project could also evolve to integrate a digital wallet capable of managing various blockchain networks and bank accounts, making it even easier to manage cross-border transactions. However, the success of BRICS Pay will depend on its ability to establish itself as a credible and viable alternative to established systems.

The launch of BRICS Pay marks an important milestone in the BRICS de-dollarization strategy. If this blockchain-based cross-border payment system succeeds in delivering on its promises, it could not only redefine trade between these nations, but also threaten the dollar’s dominance globally. In the long term, BRICS Pay could become a necessary solution for many countries that want to break free from American influence on international trade. However, it remains to be seen whether this initiative will be able to catch on and disrupt the current global financial order.

Maximize your Cointribune experience with our “Read and Earn” program! Earn points for every article you read and get access to exclusive rewards. Register now and start reaping the benefits.

A graduate of Sciences Po Toulouse and holder of the blockchain consultant certification issued by Alyra, I joined the Cointribune adventure in 2019. Convinced of the potential of blockchain to transform many sectors of the economy, I made a commitment to raise awareness and inform the general public about this ever-evolving ecosystem. My goal is to enable everyone to better understand blockchain and take advantage of the opportunities it offers. Every day I try to provide an objective analysis of current events, decipher market trends, convey the latest technological innovations and put into perspective the economic and social problems of this ongoing revolution.

DISCLAIMER OF LIABILITY

The comments and opinions expressed in this article are solely those of the author and should not be considered investment advice. Before making any investment decision, do your own research.